DOWNLOAD NOW:

Event insurance can help protect you, should something go wrong at the wedding. It’s a very small price to pay that will provide you with peace of mind when considering the very large investment you are making in your wedding day. Luckily, most weddings are free of incidents requiring you to call upon an insurance policy, but occasionally there can be theft, damage, illness or accident, vendor closings, or extreme weather.

Once you have an idea of the scope of your event, you need to talk to your home insurance provider to make sure that you have proper coverage for your property and your event. You may want to also consider getting special event insurance from an outside carrier like Wed Safe, Protect My Wedding, or RV Nuccio. Getting an alternate policy might be beneficial because if you have to make a claim on your regular homeowners’ policy, that provider may later use that claim as justification to raise your deductible or rates.

You will want to obtain comprehensive event coverage: this will protect your financial investments in the event of a postponement or cancellation, or if there is any damage or loss during the event (such as lost photos or a damaged wedding dress). And you should also get a liability policy to protect yourself from alcohol-related incidents, as well as property damage or bodily injury claims.

As with any legal document, read your policy closely, and be aware of what is covered and what is not. If you have questions, ask the policy carrier for clarification.

For more information on event insurance for your backyard wedding, please see page 46 in The Elegant At-Home Wedding!

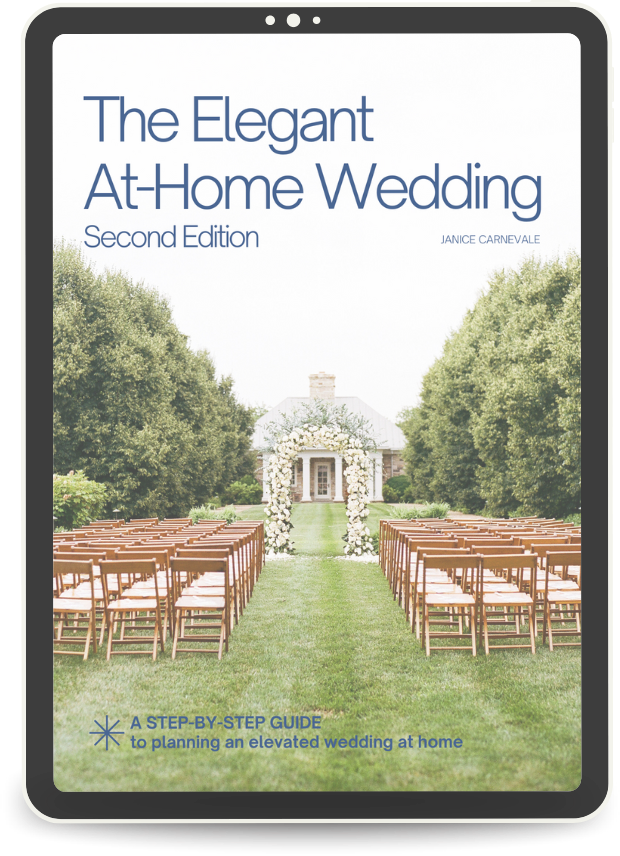

Photo courtesy of Michelle Lindsay Photography.